Two of my favorite, big-time TikTokers James Li and Ian Carroll recently posted about this subject. Since I did kind of a whole series on it a couple years back I thought I would repost so everyone can brush up. Check out the video version of baby Scott (I was a baby two years ago) holding the camera waaay too close to his face back in May 2023.

ALL for the Shareholders, Nothing for Anyone Else

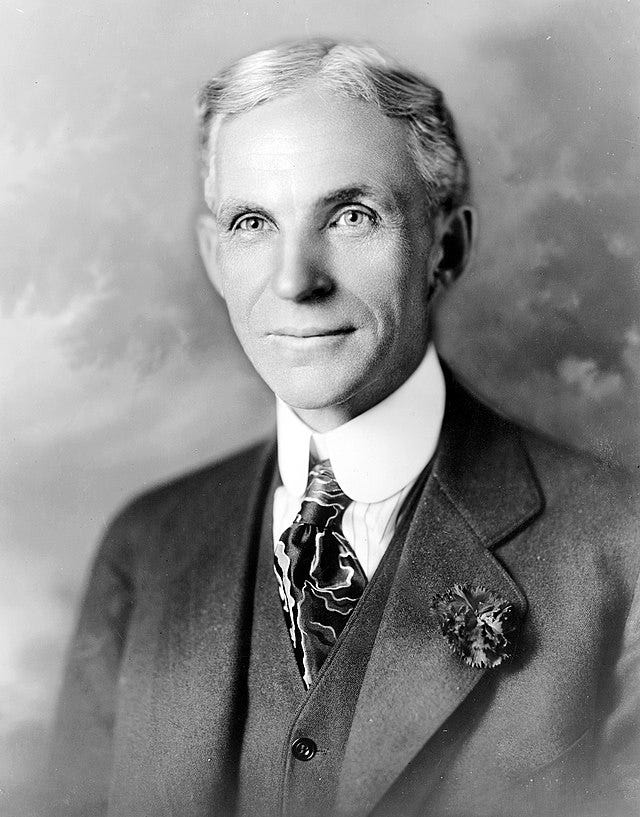

One of the biggest political movements of the last decade has been the Fight for 15. Low wage workers across the country have staged marches and strikes in their attempt to form unions and raise hourly pay to $15 dollars an hour.* As you are probably aware, the current federal minimum wage of just $7.25 an hour is not enough for people to live off of. Wealthy companies like McDonald’s and Wal-Mart say that they can’t afford to pay their employees a living wage. What’s less known is that Henry Ford paid his workers the equivalent of $15 an hour… way back in 1914.

*An ironic note: When the Fight for 15 was established in 2012 the value of $15 was more than it is currently in 2023… If the dollar had the same value now as it did in 2012 it would be called the Fight for $19.72.

In one of the most controversial moves in American business at the time, Henry Ford decided to more than double the wages of his factory workers from $2.25 a day to $5 (about triple the prevailing wage for factory workers of that day) and cut working hours from 9 to 8. In 2023 the value would be $18.67 an hour. It’s said that Ford’s idea was to turn his employees into customers by paying them enough to afford the Model Ts that they were building. In his autobiography, Ford reasoned,

“If we can distribute high wages, then that money is going to be spent and it will serve to make storekeepers and distributors and manufacturers and workers in other lines more prosperous and their prosperity will be reflected in our sales.”

It’s hard to argue with success. Within two years Ford Motor Company’s profits more than doubled.

However, in the immediate aftermath of Ford’s announcement, the global business community was outraged. The New York Times warned grimly “The theory of the management at Ford Motor Company is distinctly Utopian and runs dead against all experience.” The London Spectator took potshots saying Ford was “guided by his heart rather than his head.” The Wall Street Journal went furthest of all, chortling that the $5 day would only rid Ford “of his burdensome millions,” and that attempting such a raise was tantamount to committing “economic blunders, if not crimes.”

Two Ford shareholders were so incensed that they sued. The brothers John and Horace Dodge, whose modern-day avatars were featured in a splashy ad campaign, contended that if Ford had the money to pay out to stockholders like them – it was his responsibility to do so. Ford’s defense was that it was his company and if he wanted to invest the company’s money in raising wages and making cheaper cars rather than paying out dividends, he should be able to do so.

Ultimately Ford’s argument lost in Michigan’s Supreme Court. The Dodge v. Ford case is still taught in law schools today because the conclusion the court reached so clearly reflects today’s prevailing business theory: Nobody is more important than the shareholders. As corporate legal scholar Lynn Stout summarized, this case is important because it teaches us,

“A business corporation is organized and carried on primarily for the profit of the stockholders. The powers of the directors are to be employed for that end.”

This was not a federal case, but it summarizes nicely where the American legal system falls on the question of how the labor surplus should be distributed: All for the shareholders, nothing for anyone else. In the eyes of US law, shareholders are considered owners and the fundamental purpose of any corporation is to maximize profits for those shareholders. Full stop.

In any dispute between workers and stockholders it’s no contest, according to law. This effectively means that US law sees rich people as more important than anyone else. Why would anyone say that? Well, as of 2023, 89 percent of all stocks were owned by the wealthiest 10 percent of Americans. Every bit that the bottom 90 percent holds in 401ks, pension funds, college savings accounts, stocks, bonds, and mutual funds amounts to only 11 percent of the stock market! This is important.

Please give a like, comment, restack, and share to help other people find my Substack.

Let’s make them pay.

Great post if I don’t say so myself…

Check out this FOLLOW UP POST about the bigger picture.

Then check out this FOLLOW UP POST about the downsides of valorizing Grand Cross of the German Eagle-winner Henry Ford.

Share this post